Setting up a payment gateway is essential to selling online courses successfully. You need to set up a solution so that you can receive payments from across the globe. The bottom line to the success of your online video course is your ability to monetize your content. From our conversations with E-Learning video course creators, it is this process of setting up a payment gateway that counts as one of the most stressful aspects of selling online courses.

Table Of Content:

- What are Payment Gateways?

- Why are Payment Gateways required by eLearning Platforms?

- The Parties to a Financial Transaction

- Payment Process

- Options of Integrating a Payment Gateway to your Website

- Difference between Payment Gateway, Payment Processor and Merchant Account

- International Payment Processors

- Indian Payment Gateways

- FAQs

In this blog, we lay out how a PG works, what options to consider when opting for a gateway to your site, and how to actually apply for it.

What are Payment Gateways?

Payment gateways are online software applications that allow online platforms and businesses to accept payments from their customers. These gateways act as intermediaries between the online seller and the customer for securely transferring the payment exchange information. These gateways capture and transfer multiple information in encrypted form so as to protect the payment methods and transfer details.

Explore More ✅

VdoCipher ensures Secure Video Hosting with Hollywood Grade DRM Encryption

VdoCipher helps 2500+ customers in over 120+ countries to host their videos securely, helping them to boost their video revenues.

All major PGs are designed with multiple layers of security like SSL Encryption and Tokenization. This is to ensure that all payment data transmitted between the customer’s device, PG server, and merchant platform is secure via encryption. Similarly, tokenization replaces the actual payment information with a unique code or token, which is useless to network intercepting hackers. In case of interruption, these gateways also verify the transaction details through exception handling and transfer funds from the customer’s account to the merchant’s account.

Popular payment gateways include PayPal, Stripe, Razorpay, Square, etc., which can take payment via multiple payment modes like credit cards, debit cards, e-wallets, UPI, bank transfers, and more.

Why are Payment Gateways required by eLearning Platforms?

There are several reasons why eLearning platforms require secure payment gateways.

To accept national and international payments: The most obvious reason to add payment gateways is to accept payments made by students and learners. Payment gateways securely process payments and ensure quick and efficient transactions. These gateways can process payments in different currencies.

To integrate multiple payment options: Payment gateways allow e-learning platforms to integrate various payment methods. It includes payments made via credit cards, e-wallets, bank transfers, UPI, and more. Also, different countries allow making international payments only through restricted gateways.

To secure customer personal details: Reliable PGs are ‘Payment Card Industry Data Security Standard (PCI)’ compliant meaning credit card acceptance, processing, and storing are securely managed. After all, keeping the customers’ personal information like addresses, card details, and contact information safe and sound is important for an eLearning platform.

To reduce fraudulent practices during transactions: Payment gateways have advanced fraud detection and prevention tools to reduce the risk of fraudulent transactions. It helps eLearning platforms protect their revenue and maintain the trust of their customers.

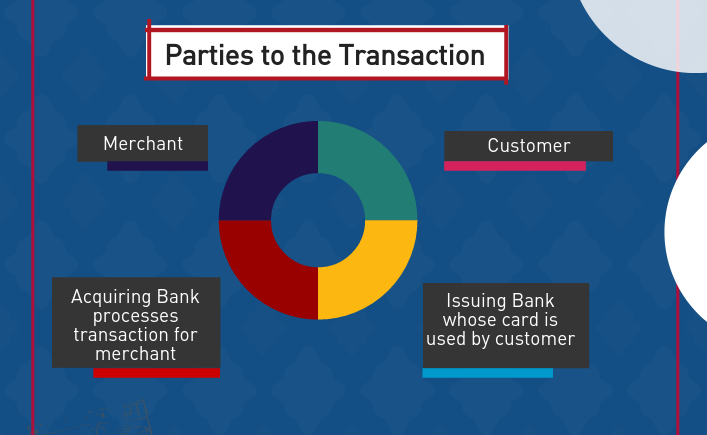

The Parties to a Financial Transaction

There are essentially four parties to an online financial transaction:

- The merchant

- The customer

- The acquiring bank whose services the merchant uses

- The issuing bank whose credit card the customer uses

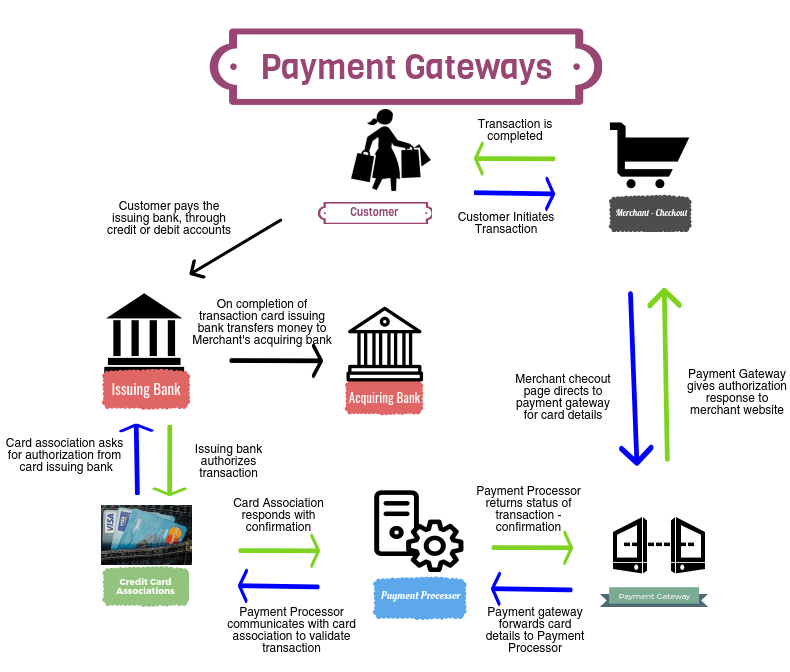

Payment Process

The workflow in the payment process works like this:

- Payment Gateway receives the card details securely from the customer

- PG forwards the transaction information to the card agency

- The card agency then forwards the request to the Issuing bank

- Issuing bank verifies the validity of the transaction for credit/ debit card (checking card details, balance, expiry dates), and responds with approve/ deny response

- The approve/deny response is forwarded by the PG to the merchant’s website

- The merchant then fulfills the order. The issuing bank clears the order only when the transaction is fulfilled

- Acquiring bank communicates with the credit card issuer to settle accounts

- Credit card issuer makes payment to acquiring bank

- Acquiring bank deposits funds to the merchant’s approved account

Options of Integrating a Payment Gateway to your Website

- Hosting payment process on your site: To make the customer experience smoother the merchant hosts the credit card details on their own servers and transfers them to the payment gateway/ processor which communicates with the relevant financial institutions. You would need to implement security mechanisms to ensure that card details are secure.

- The iFrame of Payment Gateway on Website – In this method of integration a frame of the payment gateway is included on your website, through which you can then integrate a payment gateway directly to the website. The customer remains on your website, but the data is added to the payment gateway directly, minimizing your data liabilities.

- Payment form on another site – This is the simplest process, in which the user is directed to the payment gateway site to enter the card details. The customer is redirected to the merchant’s website after the transaction is completed.

- Hosted Tokenization – The customer adds card data on the merchant’s website, but this data is sent directly to the servers of the payment gateways. The merchant website only records a unique token of the transaction, so the merchant website is not liable to possess confidential data.

Difference between Payment Gateway, Payment Processor, and Merchant Account

Payment Gateway

A payment gateway acts as an intermediary between your website and the payment processor, helping to securely transfer information. PGs must comply with PCI-DSS standards (Payment Card Industry Data Security Standard) to ensure that the details of your financial transactions are secure.

The payment gateway’s main role is to securely transfer transaction details to the payment processor. Whereas the payment gateway’s responsibility is to provide a user interface and communication channel between customer and merchant, it is the payment processor which deals with the various financial institutions to validate the transactions.

Payment Processors and Merchant Accounts

The boundary lines between the payment gateway and payment processor are often blurred, and most vendors function as both. Payment Gateways in India combine with banks to provide payment processor and merchant account services. It is the payment processor which handles transaction data and communicates with the banks. The bank handles the merchant account activities.

The stage of merchant account creation requires a lot of paperwork efforts. Banks are averse to accepting merchants with high-risk business models. For this reason, they will ask you for explanations of your business model. The requirements for a merchant account are:

- Functional website

- Company identity proof

- Promoter’s identity proof

- Company address proof

- Business model presentation

For an example of merchant requirements, online payment processor ZaakPay provides the details for availing their ZaakPay merchant services.

International Payment Processors

PayPal, Stripe, Authorize.Net, and Payline are the most popular international payment processors. WooCommerce offers integration with all of these payment processors. Their unique offerings are

- PayPal is one of the most widely trusted payment processors. PayPal charges monthly fees for Pro and Advanced Users. Its ease of use and customer support and service sets it apart from the competition.

- Stripe offers an international payment gateway plus processor service similar to PayPal. Through its APIs developers can integrate the payment gateway to their website for free. Its rates are also overall cheaper than PayPal.

Merchant Maverick here gives a very detailed explanation on how to choose a payment processor.

Indian Payment Gateways

The most popular Indian payment gateways are:

- RazorPay – This option offers net banking, all cards, and wallets. This is one of the fastest-growing payment gateway services. VdoCipher also uses it.

- PayUBiz – Offers a variety of customizations for medium-to-large businesses. One of the most trusted brands, their merchant on-boarding process is fast, and the user experience is their highest priority

- EBS – The first Indian Payment gateway to be PCI-DSS compliant

- CCAvenue – CCAvenue is one of the longest-serving payment gateways, and is widely trusted and considered reliable. Customer trust is a very important quality in the payment processing industry.

- InstaMojo – Instamojo offers the cheapest option among payment gateways. There are no installation costs, and it is recommended mainly for small-to-medium businesses providing physical goods. Their transaction discount rate is 1.9% for physical goods sales and 5% for digital goods. Their integrations leave much to be desired, however, as the service does not offer support for retail payment processors.

You can also check a guide to sell profitable online course by Podia for tips on course monetization.

FAQs

What problems do payment gateways solve?

Payment gateways make online transactions secure, and transparent and reduce the chances of fraudulent activities. Also, payment gateways accept payments made in international currencies.

Which technology is used in the payment gateway?

Payment gateways have various technologies in place to not only secure the transactions but also it is less time-consuming and more efficient. The various popular technologies used are tokenization, payment APIs, secure protocols such as Verified by Visa and MasterCard, and Secure Socket Layer (SSL) encryption.

How do I choose a payment gateway?

The various factors to consider when selecting a payment gateway are security, payment gateway charges like transaction fees, setup fees, easy integration with your site or platform, bug-free service, reputation, accepted payment methods, and customer support.

Supercharge Your Business with Videos

At VdoCipher we maintain the strongest content protection for videos. We also deliver the best viewer experience with brand friendly customisations. We'd love to hear from you, and help boost your video streaming business.

Leave a Reply